Simple Steps to Write a Check: Tips for Writing the Perfect Check

Despite having advanced technology for payments, checks still hold an important place. The traditional method of receiving and sending payments is still an operable process. If you write checks on a regular basis, this can be an effortless work. But it can be so confusing if you are writing it for the first time.

-

There are different kinds of checks, such as personal checks, cashier's checks, and traveler's checks. The checks have different ordering procedures and fees.

-

Always write the amount on the check, or else it will bounce.

Tips for Writing a Check Accurately

Follow these five easy steps if you find it challenging to write a check. These easy steps help avoid any mistakes while writing a check.

-

Write Date: The date section is located in the upper right corner of the check. The standard format to write date in the US is month/day/year. It ensures that whether the check is postdated or not. It implies the time after which the check should be encashed. It is a crucial part as the recipient will not be able to encash the check if it is written on a future date.

-

Recipient name: The recipient can be a person, organization, or business. It is advisable to write the first and last name in the case of an individual and the full name in the case of an organization or business. The recipient's name is written after "Pay to the order of." The bank confirms the identity of a person, do confirm it before writing it on the check. If you are not sure about the name, you can also write "cash," which means anyone who has the check can cash or deposit it.

-

Check amount in numeric: The third step involves writing the amount numerically. The amount should be filled in dollars and cents using numbers. It is advisable to write the amount close to the left-hand side of the check. If there are no cents, write 00 to avoid any fraud or prevent anyone from writing any number further.

-

Check amount in words: It is essential to understand that the dollar part is written in words while the cent part is written in fractions. The word part is preferred if there are mistakes or inconsistencies in the numerics or word amount. It is vital to cross out the blank spaces to prevent any misuse.

-

Signature: The signature is necessary because if the check is unsigned, the recipient will not receive the money. Write the same signature as it ensures the authenticity of the check. If, in any case, the bank finds dissimilarity, they will cross-check or won't deposit it in the recipient account.

Is there a correct way to write a check?

The above steps are very important to remember before writing a check. Despite that, there are a few additional tips that one should pay attention to.

-

For writing a check, always use a pen and avoid writing it with a pencil to prevent fraud or alterations.

-

Write in good and proper handwriting to avoid confusion, especially with the amount.

-

Ensure the correctness and accuracy of the check by double-checking before handing it to someone.

-

Maintain the records of the checks paid and keep track of the check numbers.

How to Balance the Checkbook Correctly?

As transactions occur in the digitized world, balancing a checkbook using paper and pencil is now an old thing. But, it is still important to balance the checkbook to ensure all your financial transitions are in place.

Follow these five easy steps to keep your checkbook balanced perfectly.

-

Check your current balance: You can check your account's current balance from the bank's website or application. Record the balance in the book to track it further.

-

Pending Amount: Write the uncleared transitions like outstanding checks or another amount. With the amount, also note the check number or other briefs of the pending amounts.

-

Make adjustments: Debit implies the amount going out of the account, and credit means the amount coming into the account. Subtract the debit amount and add the credit amount. Also, add the interest received and subtract the charges you have paid.

-

Make it your habit: Regularly record the transactions to maintain accuracy.

-

Periodic review: Review and check your balance every two weeks or more by logging into your bank account. Try to match the balance of your account with your checkbook. If you find any unaligned numbers, look for errors.

How do you sign a check over to someone else?

It is very crucial to ensure that the recipient or its bank accepts the check. When we sign a check for someone else, it is generally regarded as a "third-party check."

Before signing a third-party check, follow the steps to writing a check:

-

Plan and Decide: Writing a check for a third party can be complex. Planning the transaction and deciding to sign the check is very important as the third party could be an individual, organization, or business.

-

Confirm with the recipient: Confirm with the recipient whether he will accept the check, what name should be written on the check or other details.

-

Confirm with the recipient's bank: It is advisable to make sure whether the recipient's bank will accept the endorsed check or not. Banks are not compelled to accept the endorsed check.

-

Check endorsement: Sign at the back of the check; the signature must match both sides.

-

"Pay to the order of": Write the name of the third party in the endorsement areas under your signature. This confirms the transfer of ownership for the check.

-

Deliver the check: Give the check to the third party to encash or deposit.

What Happens If You Write a Check With No Money in Your Account?

If you write a check with no money in your account, it will result in the check bounce. It will also indicate that you have overdrawn from your account and a negative amount in your account. As a result, the check will be returned, and you will be charged fees for the returned check.

What Is Bouncing a Check?

When you run out of funds in your account and still make a check, the bank refuses to accept it and bounces it back to you. You are charged with a penalty fee for insufficient funds.

What Causes a Check to Bounce?

Many reasons can cause a check to bounce:

-

Insufficient funds: It is the most common reason for check bounce. It results in a penalty fee to the account holder.

-

Outdated checks: The recipient must cash or deposit the check as soon as possible. Banks don't accept checks that are older than six months. Such checks are called stale checks.

-

Incorrect information: Mistakes or missing information can also bounce a check.

How to Prevent Checks From Bouncing?

Here are a few tips to prevent checks from bouncing:

-

Overdraft protection: This service is offered to banking customers who often use checks to pay or receive money. If you go out of funds and still write a check, then the bank covers the amount. Banks charge a fee for this service, and only a limited amount is covered under this service.

-

Linked account: The checking account can be linked to your savings account. This will prevent your account from going negative as money is transferred to a checking account in case of insufficient funds.

-

Alerts: Alerts are best as they notify you in case of a low balance.

What Is a Postdated Check?

Postdated checks are written for future transitions. It means a payment or transaction should be processed on a specific future date. The check can only be processed on or after the mentioned date.

What Is a Voided Check?

Void checks are not used for payment. Instead, they are used to get information for electronic payments, account numbers, etc. It is advisable to write VOID in big letters on the front side of the check. No one uses the check.

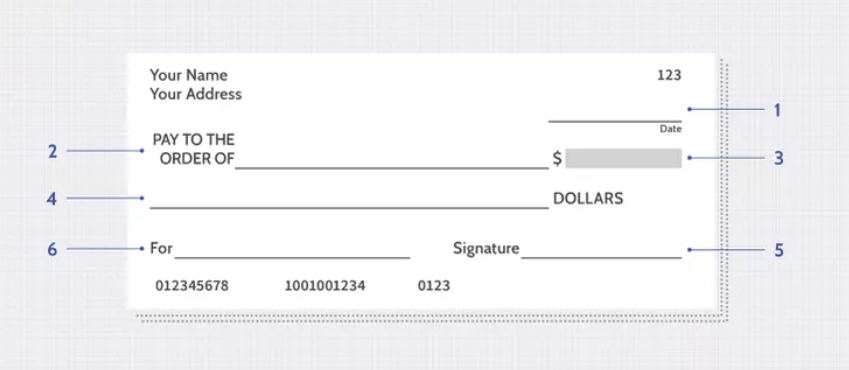

Parts of a Check

Apart from making payments, checks are also used for different purposes like checking account numbers, linking payment apps, etc. Check provides additional information like

-

Your information: The upper left corner of the check depicts the information you have provided while opening the bank account. You can find your name and address.

-

Check Number: It is located on the upper and lower right corner of the check.

-

Date: The date section is located in the upper right corner of the check. It ensures that whether the check is postdated or not. It implies the time after which the check should be encashed.

-

Recipient's name: "Pay to the order of" the palace to write the name of the recipient. The recipient can be an individual, organization, or business.

-

The amount of payment: The amount is written in numerical and word form to reduce the chances of error.

-

Memo: It is located in the bottom left corner. It is used to write the additional information.

-

Bank Name: The area jots the name of your bank, address, and logo.

-

Routing Number: The number identifies the bank within the banking system.

-

Account number: Your bank account number from which the amount will be withdrawn.

-

Signature: The signature grants the permission to withdraw the amount from your account.

Numbers on your check

At the bottom of your check, you can find three number groups. These numbers hold great significance.

-

Routing number: It is located in the lower-left corner of the check. It is a nine-digit number. It is used to identify the financial institution of your account.

-

Account number: It is the identity of your account and is unique to you and your bank account.

-

Check number: It is the last set of numbers, which is 3-4 digits long. It helps you to keep track of your checks.

Bottom line

As digital payments have paced up, writing checks has become less common. However, there are still many people who prefer to do it using checks. This single piece contains tons of information, and many people find it difficult to write a check. Ensure you don't commit a mistake while writing on a check, as a single error can put you in a situation.

Suggested Articles

to Your Advantage.webp)

0 Comments

Add a comment