Quick and Easy Mobile Check Deposit: Mobile Check Deposit Limits

Mobile check deposit offers the convenience of depositing a paper check from your banking app using your smartphone or tablet. Whether it's a personal, business, or government check, you can make the deposit hassle-free. However, there might be some exceptions to this service.

What is a Mobile Check?

Mobile is the most convenient tool for all of us to complete our everyday tasks. Mobile banking and payment systems are some of those tasks that are easy to undertake. Due to the amalgamation of digitization and banking, we barely visit our bank branches to deposit or withdraw money.

But what about a check deposit? Can it be done with the help of mobile?

Mobile check deposit has been a straightforward process for all to deposit our checks using our mobile.

You need to snap a photo of your check to deposit it with the help of your mobile.

How do you Deposit a Mobile Check?

Mobile check deposit is as easy as ordering food from the food delivery app, but of course, you must be careful when cash is the king.

-

First, you need an App: Download your bank app from the App Store or Google Play, depending on your device, if you don't have one.

-

Sign the Check: Fill out your check details using a black or blue pen and sign your name. Don't forget to write "for mobile deposit only" below your signature.

-

Launch Bank App: Open your bank application and look for the option to make a deposit.

-

Select the account: look for the account you want to put your money in, like a checking or savings account.

-

Enter the amount: Enter the amount and make sure the amount is the same as mentioned on your check. Don't round up the amount, as it needs to be exact to get accepted.

-

Snap pictures: Take a picture of your check and make sure it is crystal clear and every digit is visible. Take both front and back photos of the check.

-

Review and submit: Review the details of your check and submit. Wait for the confirmation from your bank.

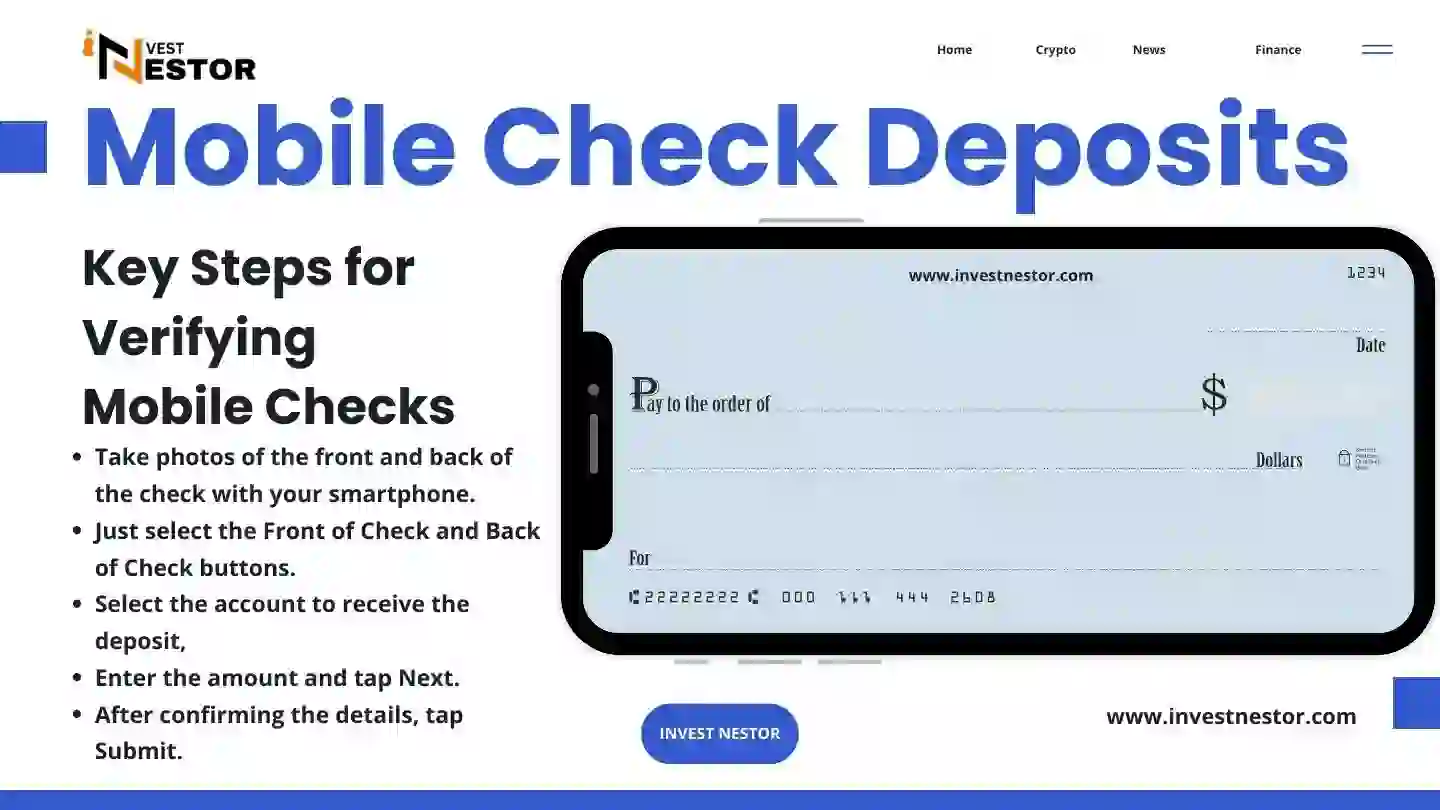

How Are Mobile Checks Verified?

Mobile check verification starts as soon as you submit the image of your check on the application. It is essential to sign the back of your check and type the correct amount for the check in the application.

Check Verification:

-

The application asks you to take a picture of the front of the check and the back of the check.

-

For easy verification and smooth processing, it is crucial that the pictures are clear and easy to read. Some applications automatically read out the amount on the check. However, verifying yourself before proceeding further is still a good idea.

Imaging and Transmission:

After submitting the images, the application sends the photos to the bank, which is safe. With the encryption code, the information is safe and secure.

-

The images of the check are very important because they are an essential element in the verification process. The bank meticulously examines the check details and ensures everything is correct.

Bank Verification:

-

The bank goes through a hefty verification process, which includes an initial check inspection. In this process, the bank verifies the signature on the back of the check as a primary security major.

-

The bank also checks the amount you have entered.

-

Your bank reviews the images you have captured and transmits them for further verification.

-

The bank also checks the account status and, once available in the issuer's account.

Banks are too cautious about the threats of fraud. Therefore, they use sophisticated fraud detection systems that scrutinize the data and identify red flags, if any.

Banks don't only rely on machines or devices but also deploy trained bank employees as an additional layer of security.

Pros and Cons of Mobile Check Deposit

Pros of Mobile Check

Mobile check deposits are becoming very popular as they have several benefits and offer advantages over manual check deposits.

-

Convenient: They are very convenient as they help to deposit your check using your mobile device without the need to go to a bank. This saves time and effort, especially when the physical bank branch is too far from your place.

-

Easy Use: The mobile banks are user-friendly, and the check deposit procedure doesn't need you to be tech-savvy. All you need is your phone, camera, an application, and the information you want to feed in the check.

-

Security: Mobile deposits are safe and secure, and the information is encrypted. Bank also uses some safety mechanisms to protect your information and data.

Cons of Mobile Check

Despite numerous advantages, mobile checks have cons that restrict many people from using them.

-

Easy yet Demanding: Although mobile check deposit is straightforward, still it is a demanding process as it needs an extra addition on the back of the check to confirm the process. For example, if you don't write "for mobile deposit only" on the back side of the check, the check might be rejected or cause delays.

-

Keep the Paper Check Safe: Even after the mobile deposit is successful, keeping the paper check safe with you is a good idea. Suppose any issue arises or the mobile application faces some glitches. In that case, you can visit your bank to make a deposit again.

-

Confirmation doesn't Guarantee Confirmation: Even after receiving the confirmation on your mobile deposit, it does not ensure it is the confirmed process. The problem arises when you don't have enough money in your account, which results in a return deposit. It also means your check has bounced, and you might face a penalty.

Is It Safe to Accept a Mobile Check?

Suppose you are wondering whether or not the mobile check deposit is safe to use. In that case, they are as secure as the other online and mobile banking functions.

But it is also good to be on the safe side and make sure the mobile check deposits are secure.

-

The mobile check deposit process is similar to the online banking process. If your bank uses encryption and other security measures, your mobile deposits are safe and protected.

-

With digitization, online scams have also evolved, where scammers try to trick people with fake deposit checks. It is advisable to recognize such scams and contact your bank.

-

Apart from these, you can also enhance the security of your mobile activities by avoiding public Wi-Fi for your banking purposes, using virtual private networks, and using a unique and regularly updated password.

Final Words

Mobile check deposits are a convenient way to deposit checks. The process is similar to other online banking functions where you use your mobile application to make check deposits. They are easy to use and save time by not tripping to a branch. All you need is to follow the proper steps.

Suggested Articles

to Your Advantage.webp)

0 Comments

Add a comment