Universal Life Insurance: Pros, Cons, and Costs of UL Insurance

There are multiple life insurance policies to choose from; however, only a few establish financial security for your family or beneficiaries and also serve as an investment tool that eventually incorporates a cash value. Is there any life insurance policy that serves as a protective measure and an investment tool? This is where universal life insurance or Permanent life insurance comes in. It operates as an investment vehicle, allowing your money to grow over time and fulfilling the insurance requirements.

What Is Permanent Universal Life Insurance?

Universal life insurance is a type of permanent Life insurance that shares common features with other permanent policies. It incorporates a cash value component and provides coverage as long as you pay your premium. The benefit of universal life insurance is that it offers flexibility and allows policyholders to adjust premiums within a specified limit. This makes universal life insurance more cost-effective than other Life insurance.

Despite having the most significant benefit, the policyholder also shares a major drawback that could impact the death benefit. If the investment yields a lower return than expected or the premiums are insufficiently paid over an extended period, it may influence death benefit or lead to policy lapse.

Key Highlights:

Universal life insurance is a type of permanent Life insurance that covers the insured's entire life.

Universal life insurance provides flexibility in premium payments and dead benefit amounts.

While universal life insurance can be flexible and have a cash value component, it can also be more expensive than other types of insurance, especially compared to term life insurance.

What Age Should You Get Universal Life Insurance?

Getting universal life insurance coverage at a young age can be a strategic financial decision as this policy has a cash value component. The earlier you start the policy, the more you accumulate cash value. This cash value can be a saving or investment that grows over a year. Also, when you are young and healthy, the life insurance premium is more affordable; hence, you can lock your policy in lower premium rates. Also, universal life insurance provides coverage for your entire life, which means as long as you pay the premium, your life is insured.

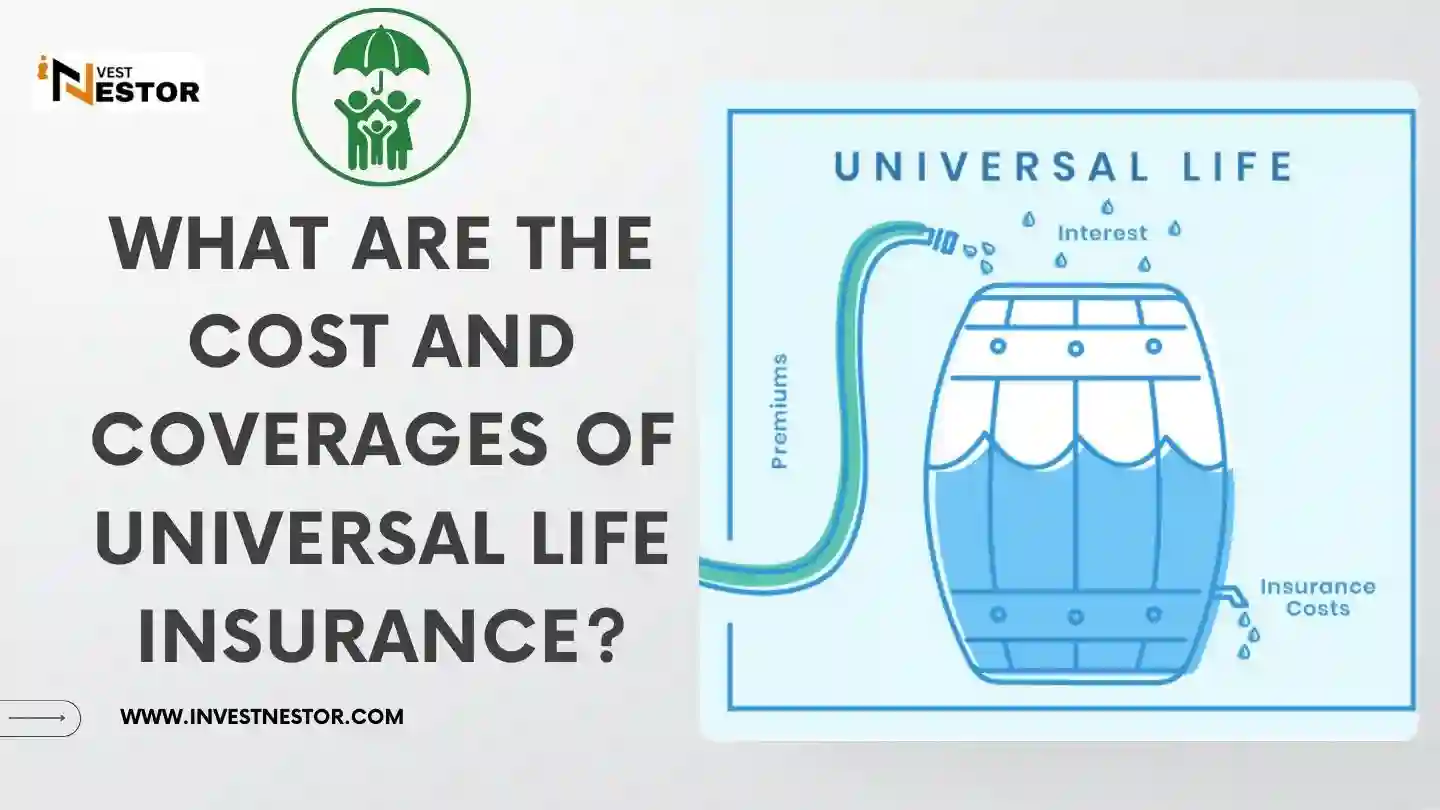

How Does Universal Life Insurance Work?

Insurance policy comes with adjustable premium payments, which makes it different from other Life insurance policies. This flexibility benefits those individuals with uncertain or variable cash flows, which helps them adapt their insurance coverage according to their financial situation.

It provides policyholders flexibility to modify the death benefit. It means a policyholder can increase or decrease the death benefit amount according to the life circumstances.

Universal life insurance provides coverage for the life of the insured with the condition of consistent premiums. This makes it a long-term financial tool that offers security and protection throughout life.

As universal life insurance is the cash value component, it is also an investment element. As the payments to premiums are made, the portion is allocated to cash value, which grows over time based on the investment made by the policyholder. The policyholder can access withdrawals or policy loans on this cash value component.

Suggested Articles: What Are the Top Ten Ways to Lower Your Car Insurance Rates

Permanent Universal Life Insurance Pros and Cons

Universal life insurance provides financial security for individuals and families in the event of an unexpected death. It offers a range of benefits, including tax savings, flexibility, and the ability to customize coverage to meet individual needs. It also has some cons, which are mentioned below, so you can make informed decisions.

Pros of Universal Life Insurance

1- It Comes with Adjustable Premiums

It means the policyholder can change their premium payments according to their financial situation within certain limits. It is suitable for individuals with unpredictable or changing financial circumstances that allow them to adapt their premium payments according to their budget.

2- It Comes with an Adjustable Death Benefit

Universal life insurance issues the flexibility to adjust the death benefit amounts, in which the insurer can increase or decrease the death benefit according to his evolving needs. However, increasing death benefits may require additional underwriting.

3- Cash Value Component

This important feature distinguishes universal life insurance from other life insurance policies. It helps the policyholder to accumulate minimal cash value over time. Another benefit is that the cash value grows on a tax-deferred basis, adding more funds to the investment.

4- Withdrawals and Policy Loan

The policyholder can acquire the cash value in a universal life insurance policy through policy loans or withdrawals. A policyholder in this policy can meet various financial needs like covering emergencies, funding education, or supporting retirement income.

Cons Universal Life Insurance

1- Complex to Understand

Due to various distinct features, it can be challenging for many policyholders to understand the universal life insurance policy deeply. Policyholders must carefully review and understand their policy's terms and conditions, such as premium flexibility, death benefits adjustment, and potential for cash value growth.

2- Difference in Cash Value Gains

It means not all universal life insurance policies guarantee gains on cash value. The cash value growth is subject to the performance of investments made by the insurance company. The policyholder must know about the potential growth in cash value accumulation and the associated risk.

3- Impact of Policy Loans and Withdrawals

Policy loans and withdrawals from the cash value can significantly impact the cash value. Though these options provide access to funds, they can depreciate the cash value and may result in increased financial obligation. If a policyholder fails to manage it carefully, takes excessive loans, and makes excessive withdrawals, it can lead to policy lapse.

How Much Is Universal Life Insurance Per Month?

Universal life insurance is permanent life insurance with insurance and saving components. This policy can accumulate cash value over time, allowing the policyholder to select flexible premium coverage amounts. When comparing term life insurance, the premium of universal life insurance may be typically higher because of the cash value component, which lasts for the policyholder's entire life.

You can expect universal life insurance if you are a healthy, non-smoker looking for $250,000 of coverage.

You might like: Exploring the Average Cost of House in USA | Cheapest US House Prices

Which Is Better, Whole Life Insurance or Universal Life Insurance?

Both universal life and whole life insurance are forms of permanent life insurance that provide coverage for the policyholder's entire life. Both these policies remain in effect until the insured's death, where premiums must be paid consistently until the policy is surrendered or canceled during the non-payment. The policyholder can choose a death benefit amount in both policies and designate beneficiaries. Both policies include a cash value component that allows the policyholder to expand savings over time and provide access through withdrawals or policy loans.

However, universal policy holds the upper hand as it involves more significant investment than whole life insurance because the cash value in universal life is often aligned to investment performance and can fluctuate based on market conditions.

On the other hand, a whole life insurance policy typically provides a fixed interest rate.

Another noteworthy feature of universal life insurance is its flexibility, where the policyholder can adjust the death benefit and premium payment within certain limits. This flexibility is suitable for individuals with changing financial needs; on the other hand, in whole-life insurance, the policyholders must pay a fixed death premium with a fixed death benefit.

What Is Universal Life Insurance Used For?

The universal life insurance policy can be used for..

Final Expenses

Universal life insurance can cover final expenses, including funeral expenses and unpaid medical bills. The death benefit provides financial resources to ease the burden on family members.

Income Replacement

For individuals with dependents, universal life insurance can serve as a means of income. The death benefit can provide financial support for surviving spouse and dependent children upon the insured's death.

Debt Coverage

Universal life insurance can be used to pay personal debt such as home mortgages or car loans. It can be used to settle the debt and prevent financial burden on the family.

Key Person Insurance

Many businesses use universal life insurance to protect against the economic loss that the business may incur when a key employee or manager dies. The death benefit can provide funds to offset the financial impact.

Life Insurance Retirement Plan or Roth IRA Alternative

Universal life insurance can be structured as a retirement saving tool that provides tax advantage growth and potential tax-free withdrawals. It can serve as a substitute for traditional retirement plans like Roth IRAs.

Final Words

Universal life insurance is a type of permanent Life insurance that combines a death benefit with the saving or investment component. It is a good option for those who don't have a flexible income flow and want to adjust their premiums according to their financial situation. Like other forms of life insurance, universal life helps create financial security for your family. It is a good choice depending on your life insurance needs, investment needs, and risk tolerance.

FAQs

What happens to cash value in a universal life policy at death?

Cash value in life insurance is designed to be used during a policyholder's life. After the policyholder's death, the cash value is returned to the life insurance company. The beneficiary often receives the death benefit without including cash value. In some cases, specific policies may offer a death benefit that includes cash value, but this feature comes at a higher cost.

Can I withdraw money from my universal life insurance?

Yes, a universal life insurance policy comes with a cash value component that provides the policyholder access to the fund whenever he needs it. With this cash value, a policyholder can meet an emergency such as home repair or business investment.

Can I borrow from a universal life insurance policy?

Yes, the policyholder has the option to take a loan against their life insurance policy. Interest is applied on this loan. However, the process doesn't involve financial underwriting, which offers the flexibility to borrow anytime.

Suggested Articles:

0 Comments

Add a comment