What Does the Most Common Type of Homeowners Insurance Cover?

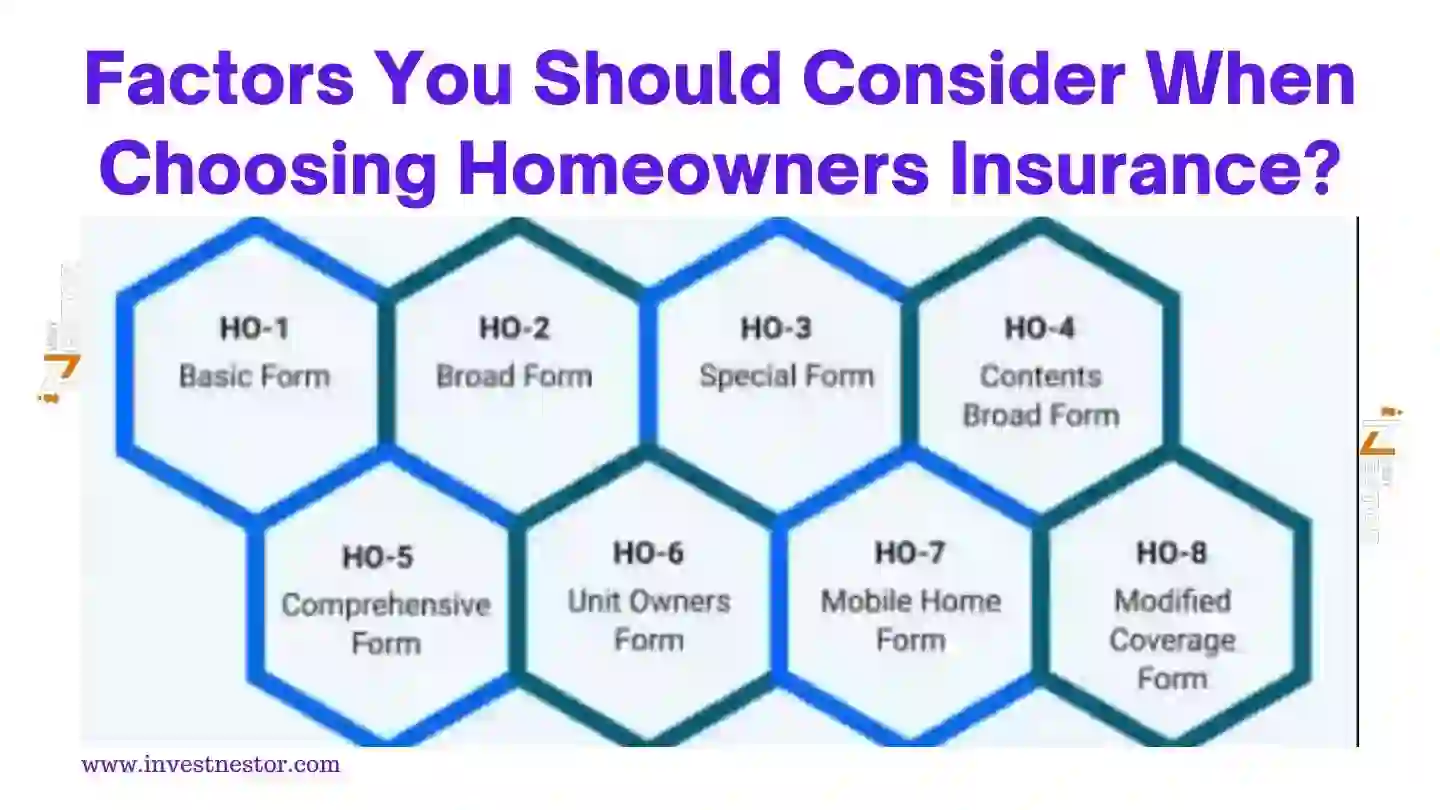

There are eight types of common homeowners insurance, each varying in price and the extent to which it covers damage. Some home insurance policies provide simple, no-frills coverage. In contrast, others might be complete in providing extra protection against different types of damage to your house and personal belongings.

Knowing the numerous types of insurance for homes will help you shop with all the necessary wisdom and choose the most suitable from a financial and structural point of view. We will walk you through the eight different policy types below to help you buy wisely.

Key Highlights

The standard HO 3 Special Form policy is the widely used home insurance coverage form.

Of all policy types, HO-5 policies feature the most coverage.

While named peril coverage means that only losses caused by certain types are covered, open peril coverage insures against all forms of loss unless otherwise excluded.

What Is the Most Common Type of Homeowners Insurance?

HO-1 Policy

A HO-1 is the most basic type of homeowner's insurance. It includes the framework of your house, any structures linked to it, such as appliances and garages, and inside components like carpeting. The things that are not covered are - Liability, personal property, and extra living expenses. It is not as popular as more robust policy alternatives because of such limitations.

As a named perils policy, HO-1 insurance only protects your house under certain circumstances, which usually include:

-

Damage from automobiles or aeroplanes

-

Explosions

-

Lightning and fire

-

Windstorms and hail

-

Conflicts

-

Smoke Theft

-

Vandalism

-

Eruption of a volcano

A HO-1 policy will cover only your house, attached structures, appliances and other features if they suffer damage from one of the perils explicitly listed in your coverage. If they are damaged by anything else, you can't make a claim with your house insurance provider and have to pay for the repairs yourself.

It is also necessary to note that an HO-1 policy does not include medical bills, liability coverage and loss of use provisions. Many insurers do not write this kind of policy because the coverage is so restricted.

HO-2 Policy

So-called a broad form, the HO-2 insurance policy covers your house and personal property. Most home insurance policies typically include coverage of your personal items, regardless of where they are – in the car, at home or elsewhere — up to a certain dollar amount. In certain situations, liability coverage may be included in HO-2 insurance.

Like the HO-1 policy, HO-2 insurance is a named perils package covering your dwelling and personal property against losses, as stated in your schedule. The losses in an HO-2 insurance are usually the same as those in a HO-1 policy, but they could also include a few more ones:

-

Unintentional leakage or spillage of water or steam inside the house

-

Freezing of HVAC systems, including pipes and air conditioning

-

Unexpected and unintentional harm caused by specific electrical currents

-

Some domestic systems are rupturing, catching fire, or breaking apart.

-

Weight of sleet, snow, or ice.

HO-3 Policy

The most preferred kind of homeowners insurance is the 'HO-3 Special Form policy', which covers your house, personal belongings, liability, added living expenses and medical payments. As opposed to HO-1 and HO-2 insurance, your home and any related structures are covered for all losses except those expressly excluded from your policy on an open peril basis.

For your house structure, it provides "open perils" coverage, which shields you from any disasters, barring those specified by the policy. On the other hand, you are covered for "named perils" for personal belongings, which protects the policy's specified disasters.

Related Articles: Pet Insurance Types and Coverage Options for Every Pet Owner

Generally, your house and other buildings are not exposed to the following risks:

- Any pets that the policyholder owns

- Birds, rodents, varmint

- Faulty building or upkeep

- Earth's motion

- Problems with flood foundations

- Governmental measures

- Purposeful loss

- Mechanical failure

- Wet rot, fungus, and mould

- Ignorance

- Danger from nuclear energy

- Rule of law or ordinance

- Animal or pet damage

- Corrosion and pollution

- Outage of power

- Smog, corrosion, or rust

- Frozen pipes, theft, and vandalism in abandoned homes

- War wear and tear

While ordinary HO-3 policies do not provide coverage for earthquakes or floods, you can obtain an endorsement or special policy to address these coverage needs.

- Damage from automobiles or aeroplanes

- The harm caused by snow or ice weight

- The harm that an electrical current causes

- Detonations

- Falling items

- Lightning and fire

- Windstorms and hail

- Pipes that freeze

- Upheavals

- Smoke Theft

- Vandalism

- Eruptions of volcanoes

- Water damage from HVAC or plumbing overflow

- Water heater impairment

Editor Picks: How to File Roof Insurance Claim: Importance of Roof Insurance

HO–4 Policy

Renters who may wish to get extra coverage like liabilities and those who want their personal belongings insured can buy a HO-4 policy, famously known as renters insurance. For this reason, an HO-4 policy is not considered an actual "homeowners" policy because the structure of any building isn't usually covered.

Typically referred to as risk plans, renters insurance covers the following occurrences:

- Damage from automobiles or aeroplanes

- The harm caused by snow or ice weight

- Harm brought on by an electrical current

- Detonations

- Falling items

- Lightning and fire

- Windstorms and hail

- Pipes that freeze

- Riots

- Smoke Theft

- Vandalism

- Eruptions of volcanoes

- Water damage from HVAC or plumbing overflow

- Water heater impairment

Suggested Articles: What Are the Top Ten Ways to Lower Your Car Insurance Rates

HO–5 Policy

The most comprehensive choice is HO-5 coverage, which covers your house, personal property, liability, additional living expenses, and other people's medical payments. In addition, these policies could have more significant available limits than the more popular HO-3 policy for items like jewellery. However, because of the stringent qualifying requirements, not all house insurers provide HO-5 insurance, and not all homeowners can acquire one.

Adams talks about the potential advantages of a HO-5 policy for people who own high-value products. "It typically costs more and may not be offered by every insurer, but if you have many valuable possessions, it might be worth it," the spokesperson adds.

Your house and personal belongings are openly insured under an HO-5 policy. Several typical exclusions consist of:

- Movement of the Earth

- Legislation or actions taken by the government

- Infestation by rats, birds, or insects

- Purposeful loss

- Mechanical failure

- Mould

- Danger from nuclear energy

- Animals

- If the property remains unoccupied for longer than two months, vandalism

- Conflict

- Floods or sewage backups that cause water damage

An HO-5 policy covers more situations and can facilitate the filing of a claim because it is written on an open perils basis rather than a named perils basis, eliminating the need to provide proof that a covered hazard caused the harm. Regular HO-3 coverage is usually less expensive than an HO-5 policy due to its higher degree of protection.

HO–6 Policy

HO-6 insurance is reserved for owners of condominiums. It includes coverage for personal responsibility, supplementary living expenses, and everything within your flat. The condo association usually has insurance coverage covering common facilities, grounds, and outside sections of the structure. Condo owners typically use Condo or HOA fees to contribute to the association's insurance coverage.

Named perils policies, or HO-6 insurance, often cover the following:

- Damage from automobiles or aeroplanes

- The harm caused by snow or ice weight

- The harm that an electrical current causes

- Explosions

- Falling items

- Lightning and fire

- Windstorms and hail

- Pipes freezing

- Riots

- Smoke Theft

- Vandalism

- Eruptions of volcanoes

- Water damage from HVAC or plumbing overflow

- Water heater impairment

HO-7 Policy

Mobile or manufactured homes, such as trailers, sectionals, RVs, and modular homes, are covered by a HO-7 insurance policy. This kind of coverage includes liability, additional living expenses, medical payments, personal items, and the construction of your house.

An open perils policy, which covers any circumstance not explicitly included in your insurance policy, covers the exterior of your property.

On the other hand, personal belongings are covered under specified perils coverage under HO-7 plans. This means that in a limited number of situations, such as the following, will your personal belongings be covered:

-

Damage from automobiles or aeroplanes

-

Explosions

-

Lightning and fire

-

Windstorms and hail

-

Riots

-

Theft of Smoke Vandalism

HO–8 Policy

The HO-8 coverage is the final category of homeowners insurance, and it is best suited for homeowners with older or more difficult-to-replace properties. This covers residences with noteworthy architecture, historically significant homes, and homes constructed using uncommon materials and techniques. An HO-8 policy can be a good choice if repairing your damaged home would cost more than its present value.

The standard coverage for housing, personal property, liabilities, supplementary living expenses, and medical payments is included in HO-8 plans. A named perils policy covers the structure of your house and your personal belongings. This covers occurrences like:

-

Harm from automobiles or aeroplanes

-

Explosions

-

Lightning and fire

-

Windstorms and hail

-

Riots

-

Smoke Theft

-

Vandalism

-

Volcano Eruption

Final words

So there you have it - Types of homeowners insurance. Homeowner's insurance is protection against storms, fires, and thieves that damage homes or belongings. Liability insurance provides coverage for property incidences and injuries. Different policy types cover different percentages of coverage. Home insurance safeguards your investment, covers unexpected costs and offers peace of mind if unplanned events arise.

FAQs

How much should homeowners insurance cost?

All features of your house, its location and the coverage options that you decide upon impact how much homeowners insurance will cost. But $1,687 for dwelling coverage with a limit of $250,000 is the norm when it comes to home insurance in the US. By quoting different companies, engaging local homeowners and researching, you might discover the cost of insuring your house.

What kinds of home insurance are available?

Eight different kinds of home insurance exist. They fit into the HO-1 to HO-8 classification. Every category has a unique set of coverage options tailored to a particular type of house.

Is homeowners insurance necessary?

There is no state or federal law that you should purchase homeowners insurance. However, if you've taken out a mortgage loan to buy your house or there's another lien on the property, your financial organization will most likely need it. However, owning your real property does not mean you are safe; for example, homeowners insurance can also help defend people's finances. If there is a complete or substantial covered loss, you wouldn't have to spend the entire cost of repairs out of pocket.

Can I decide to make my homeowners insurance named peril or open peril?

Generally, the type of home insurance you purchase determines whether you receive named peril or open peril. Depending on the insurance provider, you can upgrade to a more comprehensive home insurance type, such as a HO-5 policy, to obtain open peril coverage.

Suggested Articles:

0 Comments

Add a comment